By: Kristen M. Armstrong, Attorney

I am frequently asked to present on probate avoidance techniques, in addition to meeting with seniors who have questions about how to best avoid probate. When I ask a room full of seniors who wants to avoid probate nearly everyone’s hands shoot up! One of the more common ways to avoid probate is by utilizing beneficiary designations.

What is Probate?

Probate is the legal process through which a deceased person’s estate is properly distributed to heirs and designated beneficiaries, and any debt owed to creditors is paid off. Probate can easily be avoided using one of four techniques:

(1) Give everything away before you die;

(2) Spend everything you have before you die;

(3) Create an Estate Planning that includes a Revocable or Irrevocable Trust; or

(4) Use beneficiary designations (sometimes called Transfer-on-Death “TOD” or Payable on Death “POD”) – on everything you own.

Now, most people will not give everything they own away before they die, nor is one likely to spend or use all of one’s assets before death. That leaves the use of a revocable trust or beneficiary designations as the top two ways Americans avoid probate.

Last Will and Testament

But what about a Last Will and Testament you ask? It is a common misconception that a Last Will and Testament will help one avoid probate. The reason for this is that, by law, a Last Will and Testament must be offered for probate within six months of one’s death. If a Last Will and Testament is not offered within six months of death, the Will is no longer valid and the decedent is considered to have died intestate, or without a Will. The Last Will and Testament is simply a tool used to pass property according to the Testator’s wishes.

Beneficiary Designations

One of the easiest ways to avoid probate is to utilize beneficiary designations. Now, recall that I mentioned earlier that the only way this method works is to be sure that one has a beneficiary designation on everything he or she owns. This may include real estate, motor vehicles, bank accounts, investment accounts, savings bonds, CDs, and retirement accounts. Missing just one of these things will very likely wind your estate up in probate.

Driving around town, I see financial institutions offering “Beneficiary Review Services.” It is a great service that these banks and credit unions offer, and Shepherd Elder Law attorneys always recommend reviewing beneficiary designations. However, it is important to realize that using a beneficiary designation can cause unintended consequences to an estate plan, as can joint tenancy ownership. Here are a few examples:

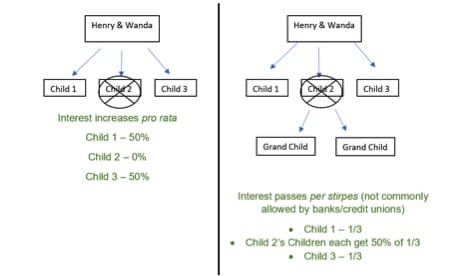

1. Death of a Child. Suppose Henry and Wanda have three children to whom they wish to leave their assets to upon their deaths. If one of Henry and Wanda’s children predeceases them, they should be aware that unless designated otherwise, it is likely that their two surviving children will split the assets 50/50. This may be what Henry and Wanda want, but if they are like most families I counsel, it isn’t at all want they want. More commonly, Henry and Wanda want their deceased child’s share to pass to the deceased child’s children (i.e., their grandchildren).

2. Failing to Retitle Assets into One’s Trust. This occurs if Henry and Wanda create a Revocable or Irrevocable trust, but fail to retitle their assets into the Trust, and fail to change the beneficiary designations to the Trust.

3. Failing to Remove an Ex-spouse as Beneficiary of an Account. Using basic contract rules, a financial institution, life insurance company, etc., must distribute assets to a former spouse unless steps were taken by the policy owner prior to death.

4. Not reviewing beneficiary designations every-so-often. It happens – financial institutions merge with other institutions, banks are sold, computer systems change – beneficiary designation forms get lost.

5. Leaving Money to a Child with a Disability. An elder law & estate planning attorney can help to protect an inheritance for a child who has a disability, however, using a beneficiary designation on a bank account which designates money directly to that child could be disastrous. Oftentimes people with disabilities are on means-based programs and risk losing medical insurance and other government benefits simply by inheriting even the smallest amount of money.

6. Minor Children. Let’s suppose that the Wanda and Henry from example 1 pass away and their designations did provide for their deceased child’s share to pass to the deceased child’s children. What happens if those children are minors? The minor children may now be looking at a probate process called conservatorship. A probate court judge will now need to be involved and will need to appoint a conservator to watch over and manage the funds until said child attains age 18. Thus, you successfully avoided probate of your own estate, but created a probate estate for your minor grandchildren.

7. Joint Tenancy. If your account has a joint owner and joint tenancy includes “rights of survivorship” (most joint tenancy accounts do), one must be aware that the joint owner will be the sole owner of the account after your death. That means that even though you have all children listed as beneficiaries of the account, they would not inherit that account until the joint owner passes. This is one reason why most estate planning attorneys advise against adding a child as a joint owner to one’s account.

Not everyone needs a Revocable or Irrevocable Trust; there are many times when I encourage clients to use beneficiary designations (and have a Last Will and Testament just in case!). However, there are oftentimes circumstances when a Trust is recommended. In addition to avoiding probate, a Trust can help to avoid some of the other issues that were outlined above.

The bottom line is that as you are reviewing your current beneficiary designations with your financial advisers and financial institutions, it makes since to include an experienced estate planning attorney in those conversations to avoid unintentionally thwarting your estate planning goals.

Recent Comments