President Biden has signed the latest COVID-19 relief bill, which in addition to authorizing stimulus checks, funding vaccine distribution, and extending unemployment benefits, also provides assistance to seniors in a number of ways.

President Biden has signed the latest COVID-19 relief bill, which in addition to authorizing stimulus checks, funding vaccine distribution, and extending unemployment benefits, also provides assistance to seniors in a number of ways.

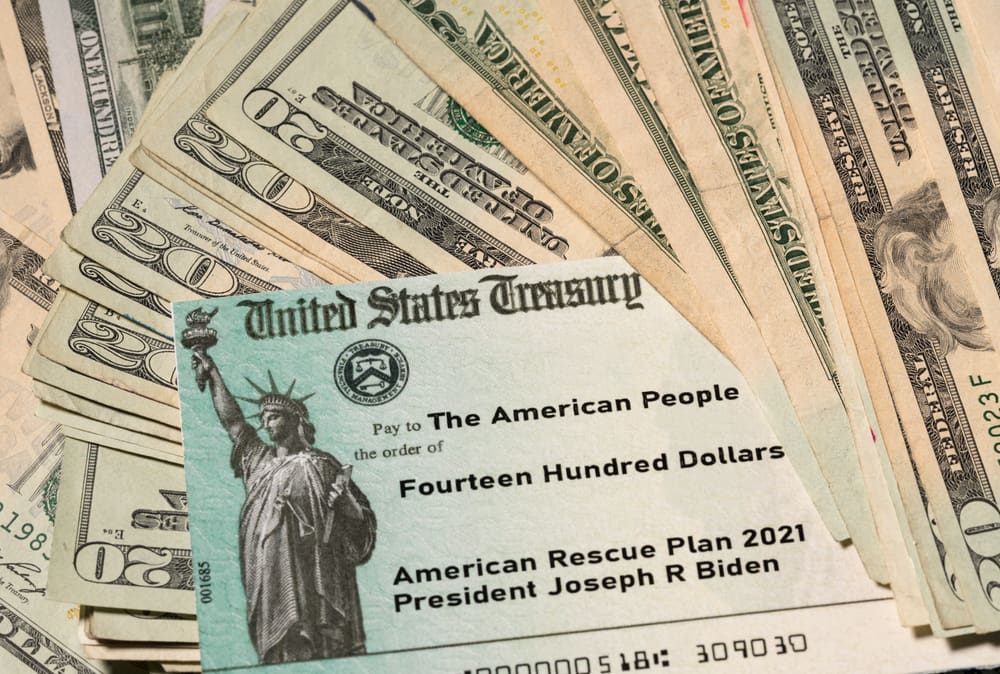

The $1.9 trillion American Rescue Plan Act (ARPA) delivers a broad swath of relief, covering families, employers, health care, education, and housing. The following are the provisions that most directly affect older Americans:

- Relief checks. The ARPA provides $1,400 direct payments to individuals earning up to $75,000 in annual income and couples with incomes up to $150,000. The payments phase out for higher earners, and there are no payments for individuals earning more than $80,000 a year or couples making more than $160,000. Eligible dependents, including adult dependents, also receive $1,400. People collecting Social Security, railroad retirement, or VA benefits will automatically receive the payment even if they don’t file a tax return. The checks will not affect eligibility for Medicaid or Supplemental Security Income as long as any amount that pushes recipients above the programs’ asset limits is spent within 12 months.

- Medicaid home care. The Act provides more than $12 billion in funding to expand Medicaid home and community-based waivers for one year. This funding will allow states to provide additional home-based long-term care, which could keep people from being forced into a nursing home. The additional money will also allow states to increase caregivers’ pay.

- Nursing homes. Nursing homes have been hit hard during the pandemic. The Act supports the deployment of strike teams to help nursing homes that have COVID-19 outbreaks. It also provides funds to improve infection control in nursing homes.

- Pensions. Many multi-employer pension plans are on the verge of collapse due to underfunding. The Act creates a system to allow plans that are insolvent to apply for grants in order to keep paying full benefits.

- Medical deductions. If you have a large number of medical expenses, you may be able to deduct some of them from your taxes, including long-term care and hospital expenses. The Act permanently lowers the threshold for deducting medical expenses. Taxpayers can deduct unreimbursed medical expenses that exceed 7.5 percent of their income. The threshold was lowered to 7.5 percent under the 2017 tax law, but was set to revert to 10 percent for some taxpayers in 2021.

- Older Americans Act. The ARPA provides funding to programs authorized under the Older Americans Act, including vaccine outreach, caregiver support, and the long-term care ombudsman program. It also directs funding for the Elder Justice Act and to improve transportation for older Americans and people with disabilities.

For more information about what is in the ARPA, click here and here.

Recent Comments